What’s the value of homeownership? There are so many, and likely some that you haven’t even considered. If you are currently renting, and would like to own a home, now is the time to speak with a loan officer. If you think homeownership is in the distant future, it’s always good to plan and understand the process and what you will need to do.

I’m sure you’ve heard the term LOCATION, LOCATION, LOCATION. But what about EQUITY, EQUITY, EQUITY? If you are renting, who do you think builds equity? I don’t know about you, but I would much rather put money in my bank account than in someone else’s account. Here are some of the obvious benefits of homeownership;

- Creating longterm equity for your family.

- No more renting for years with nothing to show for it.

- Tax deduction for mortgage interest and property taxes (check with your accountant).

- Predictable payments. Unilke rent, mortgage payments are typically fixed. Rent can increase annually.

- You can paint, hang pictures and have freedom with design of your home and yard.

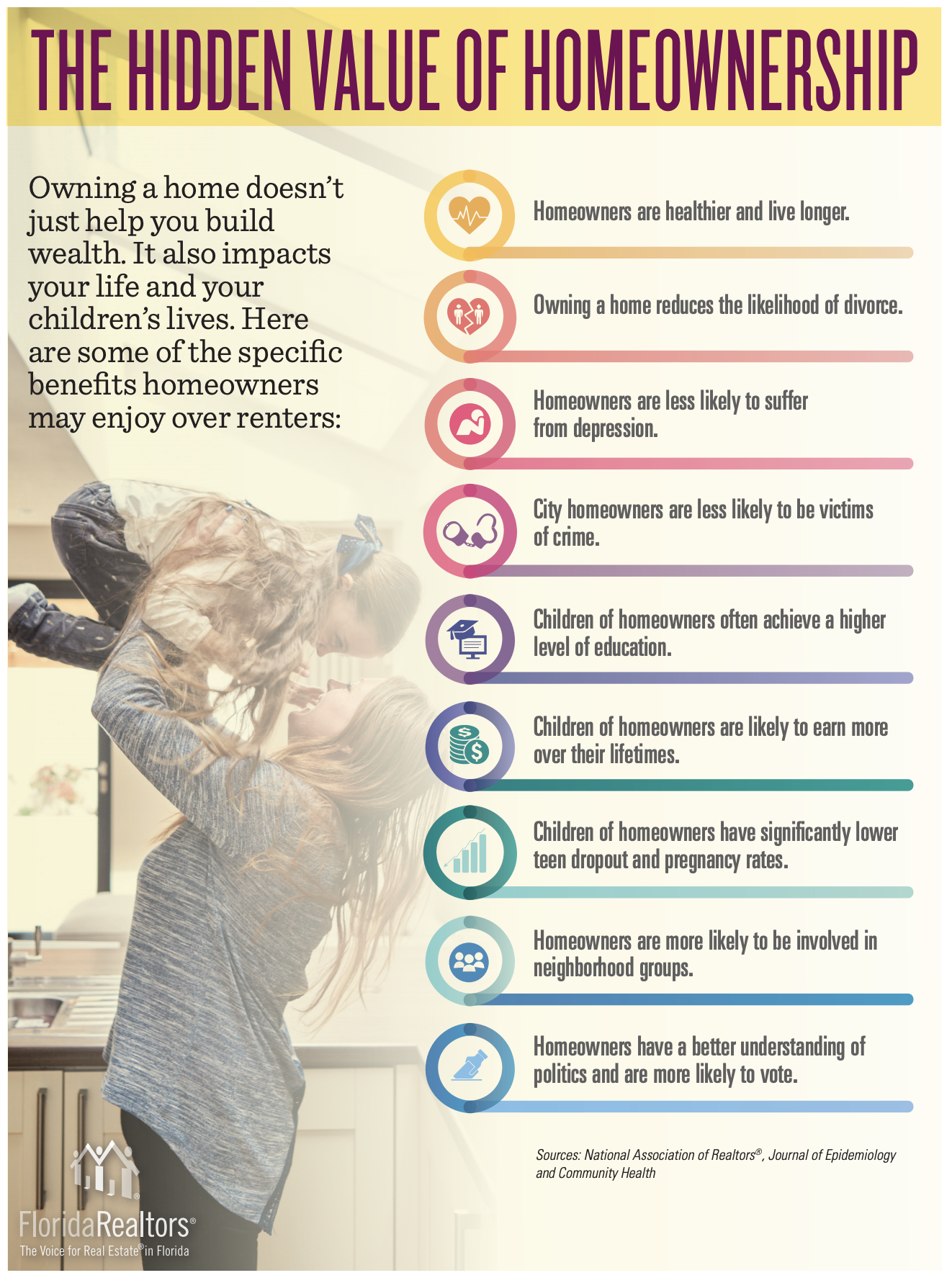

Besides the obvious benefits, take a look at this infographic highlighting some hidden benefits that most people likely don’t consider.

Being a homeowner creates value and longterm equity for YOU; not for someone else. Why put value in someone else's pocket?Click To Tweet

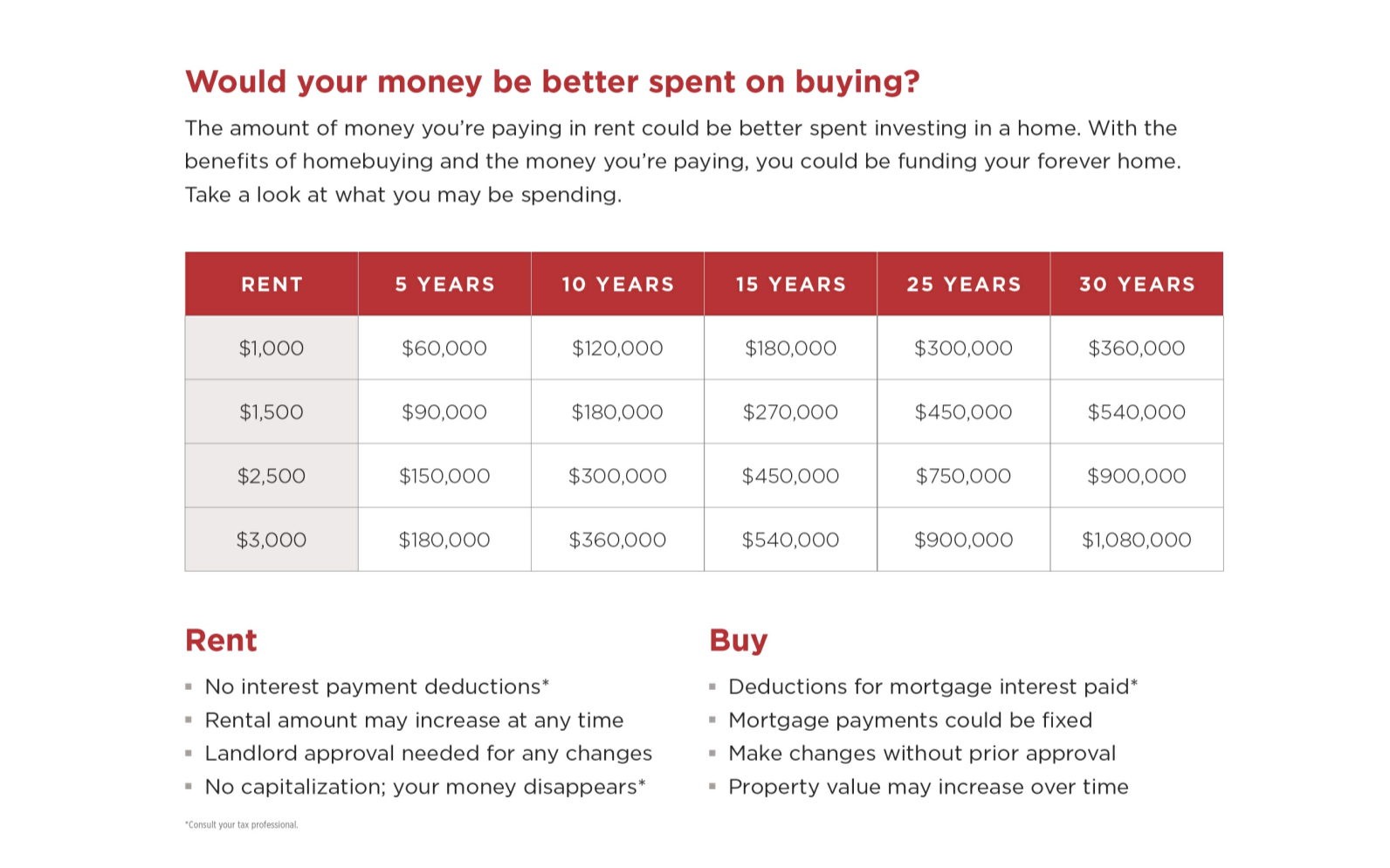

Rent vs. Owning

Loan Officer, Victoria Juran of Movement Mortgage shared this chart with me. Imagine all of that money spent in rent, with nothing to show for it after 30 years! It’s kind of like putting money in a piggy bank each month for years and when you decide to break open the bank, there’s nothing there!

Homeownership Statistics

According the Florida Realtors’® Chief Economist, Dr. Brad O’Connor,

Closed Sales are one of the simplest—yet most important—indicators for the residential real estate market. When comparing Closed Sales across markets of different sizes, we recommend comparing the percent changes in sales rather than the number of sales. Closed Sales (and many other market metrics) are affected by seasonal cycles, so actual trends are more accurately represented by year-over-year changes (i.e. comparing a month’s sales to the amount of sales in the same month in the previous year), rather than changes from one month to the next.

In the State of Florida, Closed Sales increased 17% in September and 8.5% in October. Year-to-Date 2018, Closed Sales have increased 3.3%

What’s the Cost of Waiting?

Are you ready to be a part of the homeowner stats? There could be a substantial cost to you if you delay homeownership. Here’s an example showing the difference in payments when the interest rate rises by one percentage point.

Purchase Price: $350,000.

Loan Amount: $280,000.

Interest Rate: 5% vs 6%

Monthly Payment: $1,503. at 5% and $1,679. at 6%

It may seem like a minimal increase, but that additional $176 per month adds up to OVER $63,000 during the life of the loan. When you are ready to talk about purchasing a home, talk with trusted professionals that can guide you through the entire process.

[The above numbers are used as an example. These are not guaranteed terms. There are several variables that can affect your rate and your payment. Speak to a licensed loan officer for specifics.]

When you’re ready, I’m ready to guide you into homeownership. Call me at 239-595-0205 or email me now. There are some great incentives with area builders and a good selection of resale homes on the market.